Home Buyer Hesitations: How to Handle Two Common Objections

Nov 05, 2023

You should start off by patting yourself on the back.

You're investing time in growing your expertise and becoming a market expert.

It doesn't happen overnight, but you are growing with every letter you're reading. 👍

While we don't know how this real estate commission lawsuit will pan out, one thing is clear to me:

We must continually up the value we're providing to our clients.

In the absence of value, price is the focus. 🤯

If you'd like more help becoming a Market Insider and using this material in your business, hop on the waitlist to join my coaching program which will be opening up November 13th. There will just be 30 spots so don't wait.

That said, onward to the value...

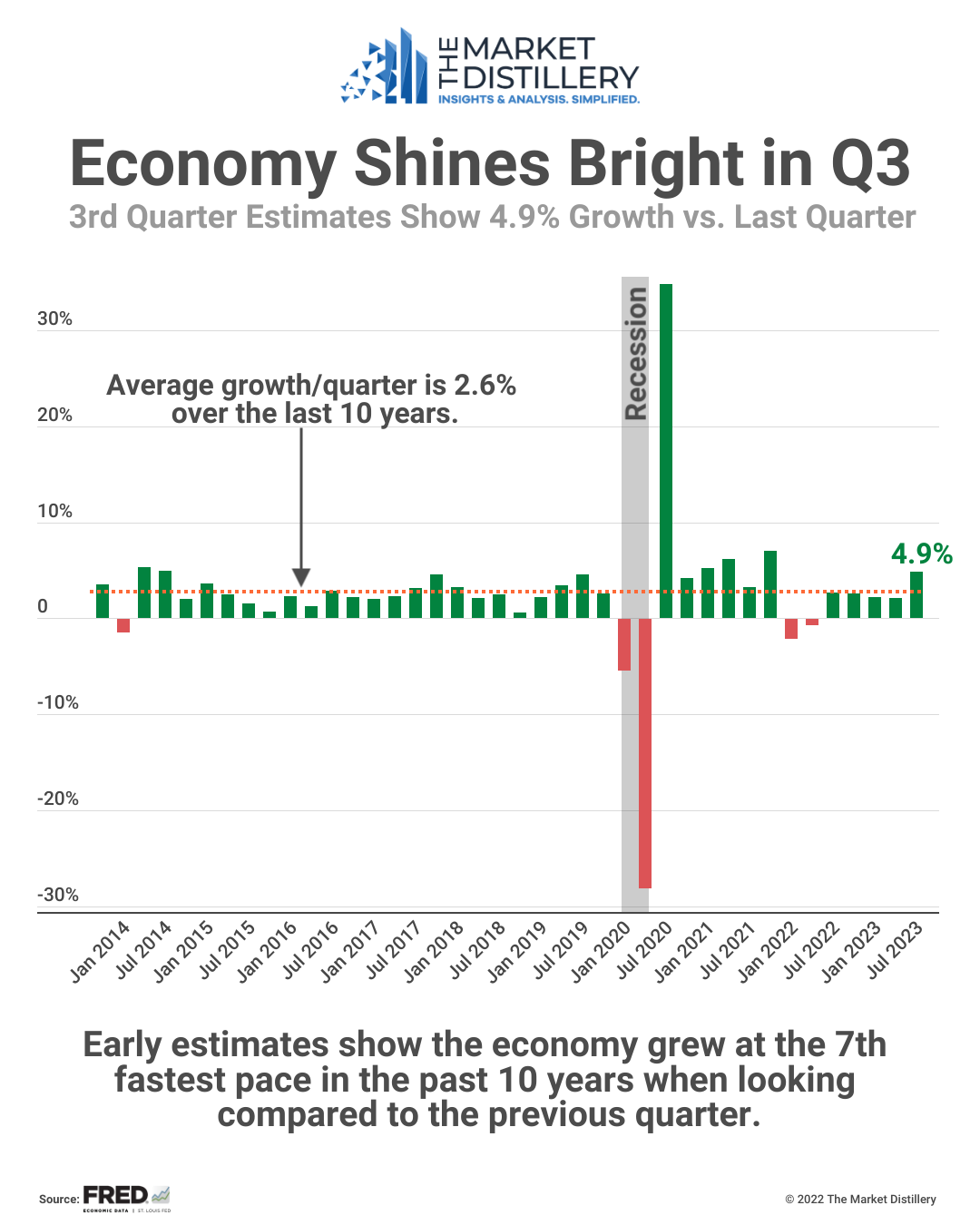

Predicting the Unpredictable

Did you hear we're going to have a recession? 😱

So did I.

This is the most anticipated recession in modern history and it hasn't happened (yet).

It absolutely could be around the corner in 2024, but this type of thing is unpredictable.

For example, look at our economic growth (GDP) last quarter. The U.S. blew it out and grew 4.9% compared to the previous quarter. 😎

Not many people would have predicted that type of growth a year earlier.

I'd wager our "leaders" in D.C. are willing to juice the markets in an election year, which could kick the can down the road another year.

The next question is how many of your clients have put off taking action towards achieving their goals based on the fear of a recession?

Too many..

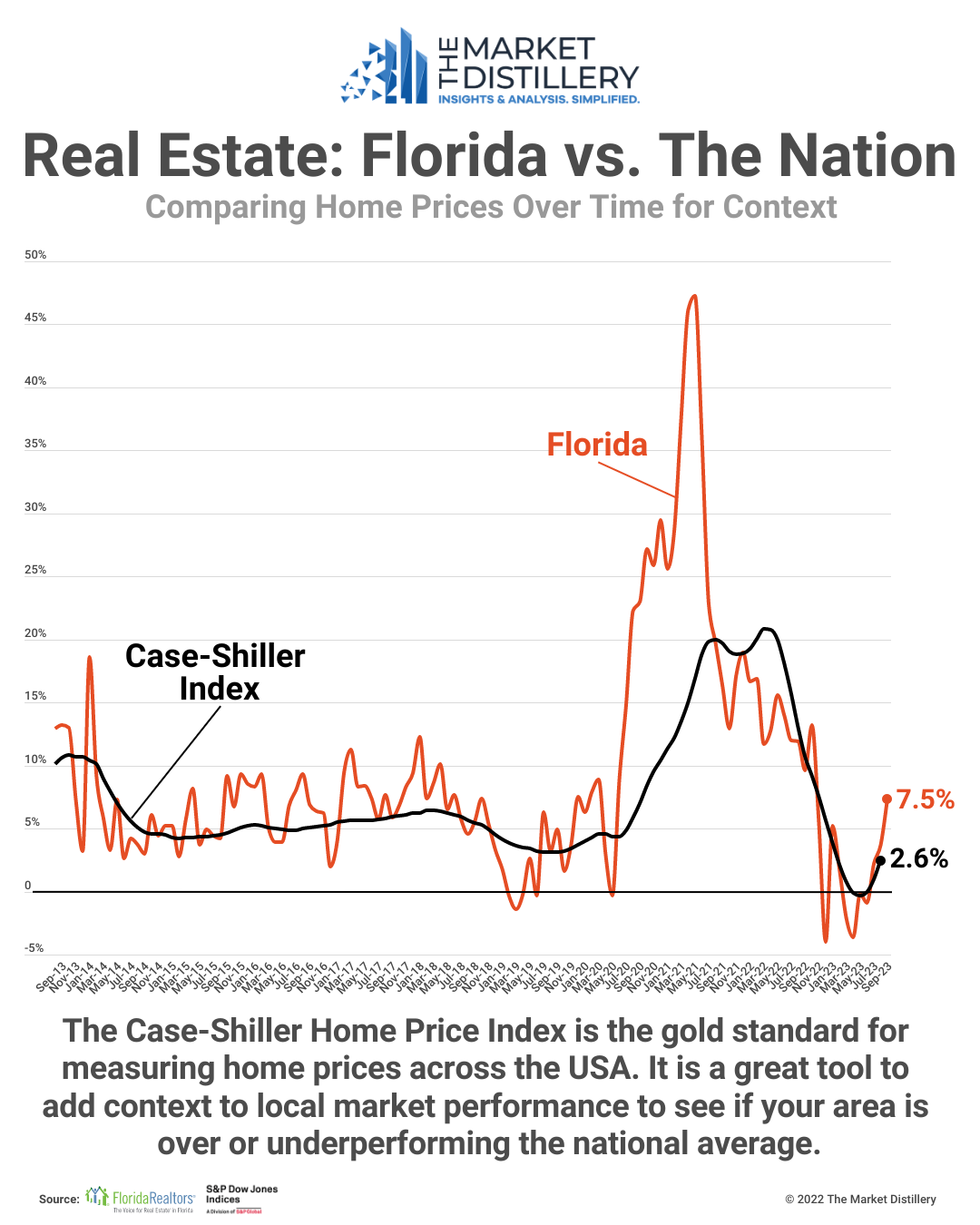

Home Prices Ahead of Last Year

The other objection many clients have is the idea that home prices are setting up for a big decline. 📉

To examine this, I've got the year-over-year change in both National home prices and Florida average prices charted above.

It's helpful to look at home prices this way because they routinely go through seasonal changes. Comparing to the same month last year lets you know if prices are truly going up or down.

You can see that prices are re-accelerating compared to this time last year.

This means those that waited are looking at higher prices and higher rates.

Double whammy. 🤦♂️

Comparing to National prices, Florida has outperformed in most months with less than 10 months of price declines in the past 10 years.

Get ready for double digit price gains in 2024 if rates come down from a Fed pivot to stimulus.

After Wednesday's press conference, I'm convinced the pivot is here. 🤫

Finding Opportunity

As humans, we have a bias towards surviving.

Our brains are wired to avoid harmful things. 🧠

Originally, it was lion attacks or rival tribes plundering our villages.

Now, financial loss makes up a big portion of our concerns.

When you know this, you can understand why so many people are hesitant to take action that carries a risk of loss.

Psychologically, the relevant term is slippery slope. It's our bias to go worst-case in our thinking and can cause us to be unrealistic about the actual likelihood of a negative outcome.

78% of you said you do this on my most recent Instagram survey and I'd wager that is pretty representative of the public.

What to do: be open to the idea that things can work out just as much as failing. 💡

It's ok to game out what could cause decisions to end up not working out, but you must force yourself to consider what could go right to stay balanced.

This should be a normal exercise with clients to help them make decisions.

It's very difficult to accurately forecast anything and we have to realize we are just making educated guesses for the most part.

Things I know:

✅ Our clients want to take action, but are fearful of what could go wrong or looking foolish to others.

✅ Real estate is a far less risky investment than most options. You get to live in it, prices move slowly, and ownership is usually over years so there's lots of time for it to pan out.

✅ Real estate has an upward bias. This means that it tends to go up over time. Just look at any chart of prices on a 10+ year timeline and you'll easily see this.

✅ Florida (especially Jacksonville) is positioned very well relative to the country. There are so many fundamental things going in our favor (relocation, economy, climate, cost of living, etc.) that will make investing in real estate a profitable choice for most owners.

Do you truly believe in real estate so strongly that your clients can feel it? 🤔

Your confidence (or lack thereof) is contagious and a major factor in your clients making decisions.

We must lead them as experts, help them see both sides of the equation (good and bad), and want their success just as much as they do.

Keep growing. Obsess over increasing your value and solving your clients' problems.

You're doing it. Keep going and I'm here to help if you need it. 🚀

Whenever you're ready, there are 3 ways I can help you:

- 🎯 Market Insiders Coaching Membership: Join an exclusive group of Realtors focused on becoming experts in our local Jacksonville market. This membership gives you access to monthly live coaching from yours truly, a member-only community for private updates and discussions, and additional resources to address clients questions and supercharge your business.

Rated 9.65 out of 10 for value to their business by my members. - 👩💻 How to Use Market Stats in Your Business: Accelerate your business growth by learning how to use data. This course will help you more easily understand the market, improve your client presentations, and increase your conversion rate with clients. No finance degree required as I lay everything out in very simple terms.

Rated 9.84 out of 10 for value to their business by 100+ Realtors. - 📊 Schedule a live presentation: Want to learn in person? I offer the MarketPulse 360 presentation that connects all the dots (national to local) so you get a comprehensive breakdown of today's market. It's 2 hours of beautiful charts designed to give you all the major trends you need to know about and address the most common questions in the market. You'll walk out feeling more confident, with resources to use in your business, and a level above the rest of the Realtors who are wandering around blindly.

Rated 9.75 out of 10 for value to their business by 300+ Realtors.

Realtors, want help understanding the local market? 🚀

What if you could anticipate how your local market would change in the coming months? Do you need help handling client questions about the market? Are you looking for a way to grow your business?

Join an exclusive group of Northeast Florida Realtors leveling up their market IQ and growing their business through local market insights. Never feel lost in the market again.

Rated 9.8 out of 10 for value to their business by my members.