Recession or Rebound? Florida's Real Estate Resilience

Jul 24, 2023

Have you heard? There's going to be a recession... 😨

The crazy thing is, this has to be the most anticipated recession in our history (which isn't that normal).

It's got clients concerned and I'm sure it's an objection you'll have to overcome in the future.

One outcome people aren't considering as much... maybe we've already had the recession. 😲

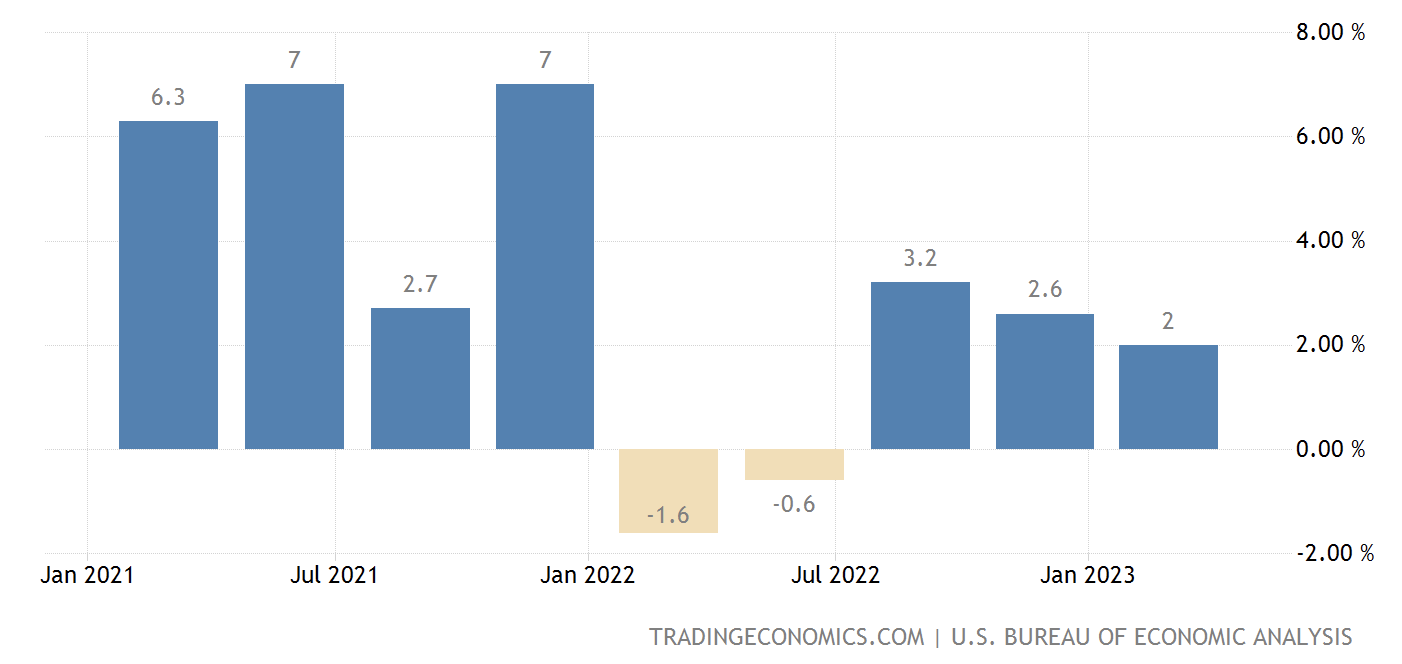

Here's a chart of the growth of the U.S. economy (otherwise known as GDP):

The traditional definition of a recession is 2 quarters of negative growth (the yellow bars in that chart).

Looks like we've already gone through a short recession in 2022 and growth since then has been positive, but slowing.

As I've said many times, "recession" is a national label and doesn't necessarily apply to your local market.

You don't care about the average temperature in the U.S. - you only care about the temp where you are. This is the same thing.

Florida grew by 3.5% while the U.S. grew 2% in the first quarter of 2023. We've outperformed the nation and a recession likely won't hit Florida as hard as other states (cough California cough cough New York). 😎

How is the Economy Growing?

One big reason our economy is growing is because retail sales continue to grow.

Consumer spending makes up 70% of our GDP growth. 🛍️

In fact, the amount of spending growth mirrors the GDP chart above when you compare the two.

Things have slowed down as rates have risen, but they've stayed positive on average.

Plus, it's arguable that we've pushed past the "housing recession" everyone felt in the second half of 2022. Growth in the housing market will fuel more growth in the overall economy.

Context for Florida Home Sales

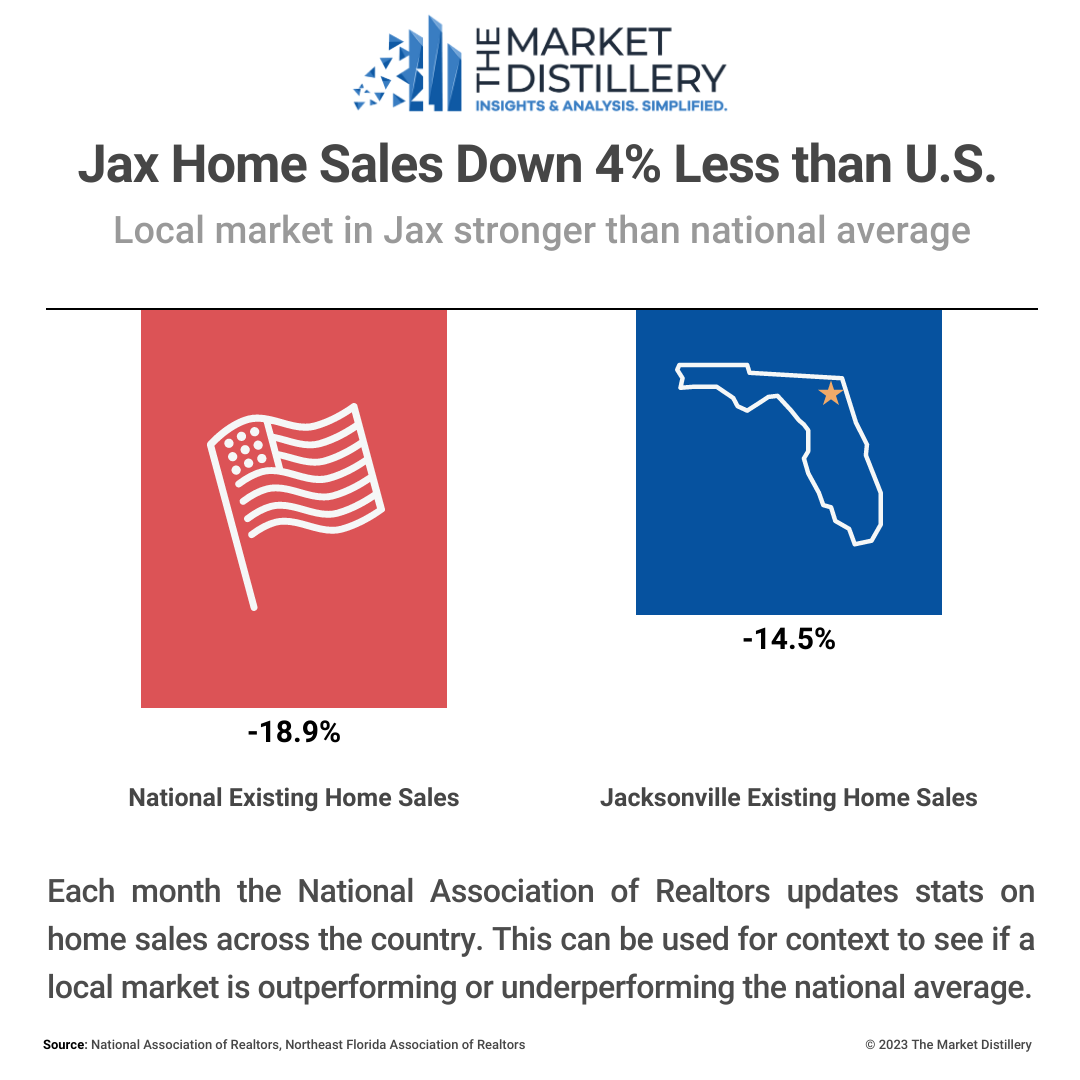

Next, I compared the recently released June existing home sales for the U.S. to Jacksonville.

You could argue we're comparing two bad numbers, but all year-over-year comparisons are going to start to look a lot more normal as we start to compare to the 2nd half of 2022 which was drastically different from the first half (when rates were 3-5%).

This comparison is more evidence of the variation between national and local economies. 🗺️

Even though we are down, we are 4% better than the nation on home sales which has a tremendous impact on our local economy.

What It All Means

This week was focused on big drivers of the economy. 💪

These topics are important because your clients (and maybe you) are potentially concerned about a recession so you need to be able to speak about it to create opportunities.

Historically, home prices (especially in Jax) have held up well in recessions except '08, which was a recession caused by housing.

Also, a decline in the economy typically reduces interest rates which help to jump start the housing market. 📉📈

It's a bit of a cycle as the gains in the housing market help to pull the country out of recession.

For reference, since 1945 the average length of a recession has been 10 months.

Should things worsen (as suggested by the severely negative 2-10 yield curve), history would suggest the Fed will do what it's always done and stimulate the economy back into growth territory and they've shown us they'll do this quickly based on their weekend decision to bail out the banks after the recent failures. 💰💰💰💰💰💰🤷♂️

This adds money to the system which pushes up house prices. People that own property will see a benefit through appreciation in this case.

-----

If you want to get access the next time I open enrollment to my coaching membership, put your name on the waitlist.

Whenever you're ready, there are 3 ways I can help you:

- Market Insiders Coaching Membership: Join an exclusive group of Realtors focused on becoming experts in their local market. This membership gives you access to monthly live coaching from yours truly, a member-only community for private updates and discussions, and additional resources to address clients questions and supercharge your business.

- How to Use Market Stats in Your Business: Accelerate your business growth by learning how to use data. This course will help you more easily understand the market, improve your client presentations, and increase your conversion rate with clients.

Rated 9.84 out of 10 for value to their business by 100+ Realtors.

- Schedule a live presentation: Want to learn in person? I offer quarterly market updates and in-person training in the Jacksonville area. Just submit a speaking request and we can get it set up.

Realtors, want help understanding the local market? 🚀

What if you could anticipate how your local market would change in the coming months? Do you need help handling client questions about the market? Are you looking for a way to grow your business?

Join an exclusive group of Northeast Florida Realtors leveling up their market IQ and growing their business through local market insights. Never feel lost in the market again.

Rated 9.8 out of 10 for value to their business by my members.