Jacksonville Real Estate: Supply, Demand, and Home Prices

Aug 19, 2023

Are we about to crash? 💣💥🏚️

That's probably a question you're asking yourself or getting from clients regularly.

Today, we look at the two major pillars of any market to get insight into the fundamentals real estate: supply & demand.

I believe these graphics can be the key to forecasting a crash with statistical evidence (not opinion).

Remember, prices do not decline unless there is too much supply and not enough demand - exactly what happened in 2008. 🥵

Here we go!

It Boils Down to Supply and Demand

When in doubt, zoom out.

More supply than demand = lower prices. 📉

More demand than supply = higher prices. 📈

(Don't confuse this with inflation. Inflation = more money in the system)

This is something you and each of your clients generally already know. 😀

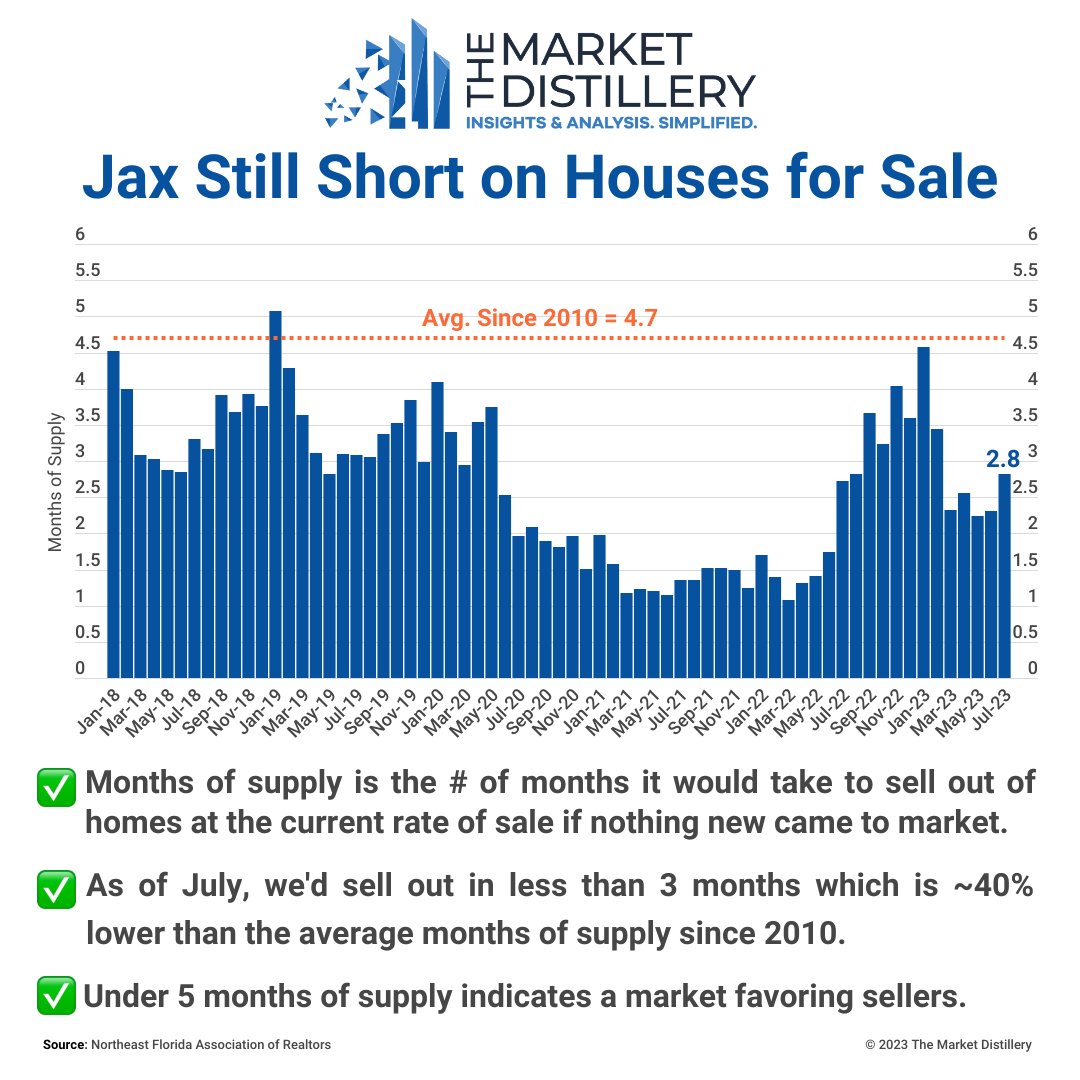

In this graphic, we examine months of supply to get a pulse on the balance of supply and demand.

It's a single number that combines both factors. It's the number of homes for sale (supply) divided by the number of closed sales that month (demand). 🤩

A number less than 5 means there's more buyers than sellers and above 5 means more sellers than buyers.

Realtors use this to determine if sellers have more control (under 5) or if buyers have more power to negotiate (over 5). These are otherwise known as a seller's or buyer's market, respectively. ☯️

Jacksonville has been a seller's markets for over 5 years given the shortage in housing for sale. 🤯

According to Redfin, most major metros are dealing with shortages of inventory:

| Region | June 2023 Months of Supply |

| Miami, FL metro area | 4.0 |

| Philadelphia, PA metro area | 2.7 |

| Chicago, IL metro area | 2.2 |

| Atlanta, GA metro area | 2.0 |

| Los Angeles, CA metro area | 2.0 |

| National Average | 1.8 |

| Washington, DC metro area | 1.4 |

| Boston, MA metro area | 1.1 |

| Seattle, WA metro area | 1.1 |

By the way, my coaching members get access to a full breakdown of all the trends driving demand up and supply down in Florida. Sign up to join or book a presentation in your office.

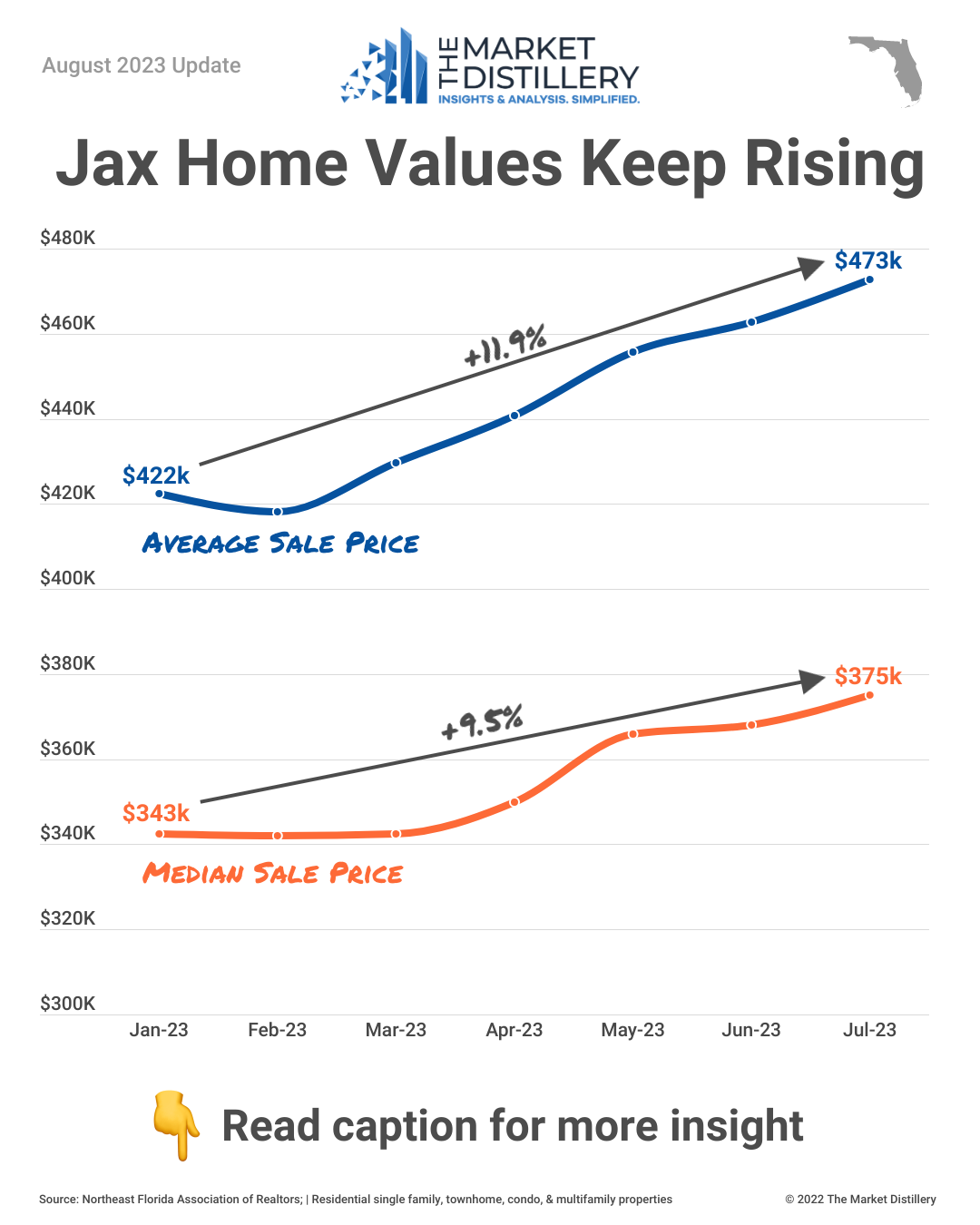

Home Prices Up Big Year-To-Date

As a result of this market imbalance, we continue to see prices rise in Jacksonville (and most areas in the country).

The average sales price is up ~12% and the median is ~10% higher so far this year. 😲

Remember, the average takes all the sales that month and divides the total dollars by the number of sales. A really big or small sale could move the average (especially if there aren't a lot of sales in a market).

The median is the exact middle price and ignores the lower and higher sales.

Most economists use median to avoid the influence of outliers, but I prefer to look at them both for the complete picture.

What It All Means

The imbalance of more demand than supply has been status quo for a while now and there aren't many signs that it's going to change.

Owners of existing homes are locked in at very low payments and holding out until rates go below 5%.

That leaves new construction as the main source of homes to buy. Unfortunately, builders are facing a variety of challenges and it doesn't appear that they'll fill the gap anytime soon.

Building permits for single family homes are down nearly 30% vs. last year in Jacksonville according to the Northeast Florida Builder's Association (NEFBA).

Put it all together and this suggests to me that we'll see this trend continue until there are major changes causing supply to rise significantly, demand to fall significantly, or some of both. 😡

Each year has felt like the peak in most markets until prices move higher.

Focus on the big picture and recognize that buying a house is a long-term investment. It's also an investment that has an upward bias - meaning it generally goes up over time. 📊

Very few people look back 3 years from buying and feel like they got a bad deal. 😉

Whenever you're ready, there are 3 ways I can help you:

- Market Insiders Coaching Membership: Join an exclusive group of Realtors focused on becoming experts in their local market. This membership gives you access to monthly live coaching from yours truly, a member-only community for private updates and discussions, and additional resources to address clients questions and supercharge your business.

- How to Use Market Stats in Your Business: Accelerate your business growth by learning how to use data. This course will help you more easily understand the market, improve your client presentations, and increase your conversion rate with clients.

Rated 9.84 out of 10 for value to their business by 100+ Realtors.

- Schedule a live presentation: Want to learn in person? I offer quarterly market updates and in-person training in the Jacksonville area. Just submit a speaking request and we can get it set up.

Realtors, want help understanding the local market? 🚀

What if you could anticipate how your local market would change in the coming months? Do you need help handling client questions about the market? Are you looking for a way to grow your business?

Join an exclusive group of Northeast Florida Realtors leveling up their market IQ and growing their business through local market insights. Never feel lost in the market again.

Rated 9.8 out of 10 for value to their business by my members.